WhatsApp)

WhatsApp)

Sales and Use Tax Exemption Relating to Film, Television, and Video Pursuant to Utah Code Ann. Section . R86519S121. Sales and Use Tax Exemptions for Certain Purchases by a Mining Facility Pursuant to Utah Code Ann. Section . R86519S122.

How 2020 Sales taxes are calculated in Ogden. The Ogden, Utah, general sales tax rate is %.Depending on the zipcode, the sales tax rate of Ogden may vary from % to % Every 2020 combined rates mentioned above are the results of Utah state rate (%), the county rate (%), the Ogden tax rate (0% to %), and in some case, special rate (%).

The Utah state sales tax rate is %, and the average UT sales tax after local surtaxes is %.. Counties and cities can charge an additional local sales tax of up to %, for a maximum possible combined sales tax of %; Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax; Utah has a higher state sales tax than % of states

Annual if tax is less than 3,000 Quarterly prepayments required if tax exceeds 3,000 Payment due: Annual: June 1 Quarterly prepayments: June 1, September 1, December 1, and March 1: Forms: TC685; must be filed electronically through Taxpayer Access Point: Rule: R86516R: Statutes: §595 Part 2: Revenue: Used for Utah''s general fund ...

To find out the exact fee for your particular vehicle, please call the DMV at or 1800DMVUTAH (). Uniform fees also apply. Sales Use Taxes. Sales and use tax is imposed on the purchase of a vehicle or watercraft and is calculated using the purchase price. The purchase price includes any value of the consideration given.

Texas imposes a percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax .

The Utah Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Utah. Just enter the fivedigit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Utah, local counties, cities, and special taxation districts.

The % sales tax rate in Farmington consists of % Utah state sales tax, % Davis County sales tax, % Farmington tax and % Special can print a % sales tax table tax rates in other cities, see Utah sales taxes by city and county.

A recent analysis commissioned by the Utah League of Cities and Towns forecasts that municipalities could see an average 25% decline in sales tax revenues for the pandemicslammed months of March ...

How 2020 Sales taxes are calculated for zip code 84737. The 84737, Hurricane, Utah, general sales tax rate is %. The combined rate used in this calculator (%) is the result of the Utah state rate (%), the 84737''s county rate (%), the Hurricane tax rate (1%), and in some case, special rate (%). Rate variation

31 rows· Jul 01, 2020· Utah (UT) Sales Tax Rates by City. The state sales tax rate in Utah is .

Gain a better understanding of the hottest issues in Utah sales and use tax. Many companies in Utah overpay millions of dollars in sales and use tax. Others underpay because they are unfamiliar with the law, and are stuck with 3year retroactive audit deficiencies. This .

The Sandy sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Utah, visit our statebystate guide. Automating sales tax compliance can help your business keep compliant with changing sales tax laws.

The normal sales tax exemptions under Utah Code do not apply to the Municipal Energy Sales and Use Tax. MACHINERY AND EQUIPMENT AND NORMAL OPERATING REPAIR OR REPLACEMENT PARTS USED IN A MANUFACTURING FACILITY, MINING ACTIVITY OR WEB SEARCH PORTAL Sales Tax License No.

How to calculate Sales tax in Weber County, Utah. If you are a traditional pencil and notepad manual math type person you can calculate the Sales Tax in Weber County, Utah manually by using the latest Sales Tax Rates for Weber County, Utah and supporting Sales Tax Formula.. For those who would rather forgo the agony of manual math calculations, particularly those associated with deducting ...

It''s money the state is expecting to get beginning Jan. 1, 2019 from outofsate online sales tax collections. (KUTV) — Who is getting millions in tax breaks? It''s such a secret that the ...

Additionally, a sale of more than 80% of a business is excluded from the definition of a "sale" for sales tax purposes. Wyoming Stat. Ann. § (a)(viii) specifically taxes ".the repair, alteration, or improvement of tangible personal property; and various services .

2006 Utah Code — Exemptions. . Exemptions. The following sales and uses are exempt from the taxes imposed by this chapter: (1) sales of aviation fuel, motor fuel, and special fuel subject to a Utah state excise tax under Chapter 13, Motor and Special Fuel Tax Act;

Jul 17, 2020· The proposal to reduce mining industry tax deductions to 60% of current levels won unanimous support from Democrats, who''ve long argued mining businesses should pay more in taxes.

Sales Tax Exemptions by Category (Source: Utah Code Section and Utah State Tax Commission) Year Enacted 104) (based on TRC data and recent legislation) Estimated State Sales Tax Amount (n/a means there is little or no reliable data available upon which to base an estimate; click to view annual reports) Brief Description of Sales Tax ...

According to Sales Tax States, 61 of Utah''s 255 cities, or percent, charge a city sales tax. They also state that the average combined sales tax rate of each zip code is percent.

*Purchaser must provide sales tax license number in the header on page 1. NOTE TO PURCHASER: You must notify the seller of cancellation, modification, or limitation of the exemption you have claimed. Questions? Email taxmaster, or call or . * Commercial Airlines I certify the food and beverages purchased are by a commercial

Other 2020 sales tax fact for Utah As of 2020, there is 57 out of 255 cities in Utah that charge city sales tax for a ratio of %. There is also 74 out of 360 zip codes in Utah that are being charged city sales tax for a ratio of %. Last sales taxes rates update. The last rates update has been made on February 2020. Utah Region zip ...

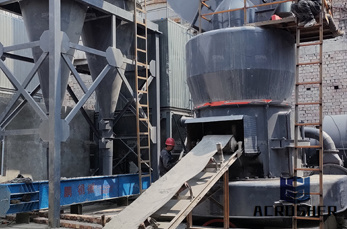

MINING () CONSTRUCTION () ... Utah Code – Sales and Use Tax Act; General Information – Tax Commission Publication 25 ...

WhatsApp)

WhatsApp)