WhatsApp)

WhatsApp)

The said capital goods were cleared by the appellant to the appellant''s MHE Division vide material dispatch Advice No. 609 dated and 627 dated The capital goods mentioned at serial number 1 2 above are installed in shed number C2 and capital goods mentioned serial No. 3 in shed H2 of M/s EEL at MHE Division.

Oct 05, 2011· Some of the units are claiming area based exemption. Therefore they are not allowed to take Cenvat Credit on Capital goods as per the exemption notification. In a case certain equipments were brought to one such exempted unit (not having Central Excise Registration) for installation of a Captive Power Plant (CPP).

Jul 07, 2014· Revised central Excise Rules, 2002 and CENVAT Credit Rules, 2002 enacted. ... Partial roll back of central excise duty from 8 per cent to 10 per cent. ... Excise duty cut on capital goods.

Dec 13, 2013· sir, we would like to send cenvat credit utilised capital goods on lease basis what documents to be carry with the goods, i have seen one article that % cenvat we need to reverse per quarter, we have utilised this machine for 11 quarters which will come to %, duty utilised 4 lakhs, what about balance amount of cenvat utilized value and what documuents to carry with machine.

CENVAT credit availed was inadmissible. Discuss, with the help of a decided case law, if any, whether the Revenue‟s objection is valid in law. CENVAT credit – Job work provisions . 3. Narmada Manufacturers, a nonSSI unit, purchased some inputs and a machine (eligible as capital goods for CENVAT purpose) on first day of a month.

May 25, 2012· CCE v. Tata Advanced Materials Ltd. 2011 (271) 62 (Kar.) Facts of the case: The assessee purchased some capital goods and paid the excise duty on it. Since, said capital goods were used in the manufacture of excisable goods, he claimed the CENVAT credit of the excise .

The CENVAT credit so allowed can be utilized for payment of : (i) any duty of excise on any final product; or (ii) an amount equal to CENVAT credit taken on inputs, if such inputs are removed as such or after being partially processed; or (iii) an amount equal to the CENVAT credit taken on capital goods, if such capital goods are removed as ...

Description of the excise registers set. Partial CENVAT Credit . Indicates that the excise registration ID is allowed to credit only a portion of its input excise duty to its CENVAT account. Dependencies . When you post a goods receipt, the system splits the input excise duty on the material into its deductible and nondeductible amounts.

Sep 29, 2012· Subrule (5B) of Rule 3 of the CCR provides that if the value of any: (i) input, or (ii) capital goods before being put to use, on which CENVAT credit is taken is written off fully or partially or where any provision to write off fully or partially (, ) has been made in the books of account, then the manufacturer or service provider is required to pay an amount equivalent to the ...

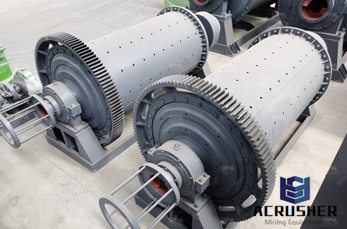

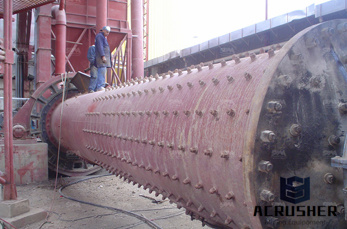

cenvat credit on capital goods as roll mill of roll in ... cenvat credit on capital goods as roll mill of roll in . Draft Audit Report Central Excise and Customs, Raipur 30 Sep 2013 which is not permissible under Rule 3 of ... » Learn More. requirement of capital in .

Roll Mill Customs Tariff Number. central excise tariff no of ball mill components. central excise tariff no of ball mill components. ball mill exporters importers amp export import data. ball mill india exporters importers amp export import data, custom duty,drawback,io norms, hs code,notification information .parts of lime stone ball mill slurry pump with motor amp accessories parts of lime ...

Feb 18, 2013· Hence, the aforestated goods viz. the flexible plastic films used for testing the FS machines are inputs used in relation to the manufacture of the final product and would be eligible for CENVAT credit under rule 57A of the erstwhile Central Excise Rules, 1944 [now rule 2(k) of the CENVAT Credit Rules, 2004].3.

Dear Sir, In Excise notification 21/2014 ce(nt) it is mentioned that time limit for availment of cenvat credit of 6 months is applicable to input (Rule 4(1)) and inputs services of cenvat credit rules 2004 only, So whether the time limit of 6 months is applicable to capital goods also,please expalin, thanks and regards. Posts / Replies. Showing Replies 1 to 8 of 8 Records

Obviously, the applicant, during the period prior to, had been availing credit of duty paid on inputs/capital goods and service tax paid on services used in or in relation to the activity of extraction/manufacture of coal in terms of Cenvat Credit Rules 2004, and utilizing the same for payment of duty due on coal manufactured and ...

H. AMENDMENTS IN CENTRAL EXCISE RULES AND CENVAT CREDIT RULES. ... channels, CTD or TMT bars and other items used for construction of shed, building or structure for support of capital goods. 3) Notification Nos. 33/97CE (NT) dated, 44/97CE (NT) dated and 7/98CE (NT) dated are being amended with retrospective ...

Prior to the appointed day for roll out of GST, the applicant had been registered with Central Excise department under the existing Central Excise Order Number OL 201S PROCEEDINGS (Under section 98 of the Madhya Pradesh Goods and Services Tax Act,2017) 1. BRIEF FACTS OF THE CASE ''the Applicant''), are having Registration

May 26, 2016· The Cenvat Credit Rules 2004 [As amended by Notification No. 28 /2016Central Excise (NT), Dated: May 26, 2016] In exercise of the powers conferred by section 37 of the Central Excise Act, 1944 (1 of 1944) and section 94 of the Finance Act, 1994 (32 of 1994) and in supersession of the CENVAT Credit Rules, 2002 and the Service Tax Credit Rules, 2002, except as respects things .

Jun 20, 2017· Credit of both Central and State taxes paid on goods in transit on the day of the transition is available on the basis of duty .

and service tax paid on input services can be availed under the CENVAT Credit Rules, 2004. (3 marks) (b) Mention the circumstances under which a price less than the manufacturing cost and profit of excisable goods can be deemed to be the transaction value under section 4 of the Central Excise .

"the tax on services should be fully integrated with the existing CENVAT on goods b y a modern VAT type levy on all goods and services to be imposed by the central government (CGST)." Th e

I Ltd. claimed Cenvat credit on the duty paid on furnace oil used for generation of electricity as it was used within the factory and was covered by the expression "for any other purpose" in rule 2(k) of the Cenvat Credit Rules, 2004. The Central Excise Department wanted to deny the Cenvat credit on the duty paid on furnace oil for generation ...

SP Ltd. purchased capital goods worth,44,200, inclusive of excise duty %, on CENVAT credit attributable on such capital goods was duly accounted for. You are required to compute the amount of CENVAT credit to be reversed, if the capital goods were removed, after being used, on 3 (0) (d)

1. CENVAT Credit Rules, 2004 . CENVAT Credit Rules, 2004 (CCR 2004) have been notified vide Notification No. 23/2004Central Excise (NT) dt. . The same is in supersession of CENVAT Credit Rules, 2002 (CCR 02) and Service Tax Credit Rules, .

A Service Tax Remitted (levied on earnings) after availing Cenvat Credit (201617) 4826 B Taxes Paid on Stores/ Services (1) Revenue Expenditure i. Excise and Customs Duty 3201 ii. Sales Tax, Service Tax and VAT 2221 (1) Total (i+ii) 5422 (2) Capital Expenditure i. Excise Duty ii. VAT iii. WCT iv. CST v. Customs Duty ...

WhatsApp)

WhatsApp)